In today’s ever-evolving financial landscape, individuals and businesses alike find themselves navigating a complex and often unpredictable frontier. Rapid technological advancements, economic uncertainties, and shifting global dynamics have made it more challenging than ever to achieve financial success. However, with the right strategies and mindset, one can not only survive but thrive in this financial frontier. In this article, we will explore key strategies for success in today’s financial world.

Financial Literacy: The Foundation of Success

Financial literacy is the cornerstone of financial success. It’s surprising how many individuals and businesses operate without a clear understanding of basic financial concepts. Whether you’re managing personal finances or running a company, a solid grasp of financial principles is non-negotiable.

Personal Finance: Budgeting and Saving

For individuals, financial literacy starts with budgeting and saving. Creating a budget allows you to understand your income, expenses, and areas where you can cut back or invest more. It’s the first step towards financial control. Save consistently and build an emergency fund to safeguard against unexpected expenses.

Business Finance: Financial Statements

In the business world, financial literacy means understanding financial statements – income statements, balance sheets, and cash flow statements. These reports provide critical insights into a company’s financial health and help in making informed decisions.

Diversification: Spreading Risk

The adage “Don’t put all your eggs in one basket” holds true in the financial frontier. Diversification is a fundamental strategy for reducing risk in your financial endeavors.

Investment Diversification

When investing, diversify your portfolio across various asset classes such as stocks, bonds, real estate, and commodities. Diversification helps you spread risk, ensuring that the poor performance of one asset doesn’t devastate your entire portfolio.

Business Diversification

For businesses, diversification can involve expanding product lines, entering new markets, or even acquiring complementary businesses. Diversifying your revenue streams can help mitigate the impact of economic downturns in specific sectors.

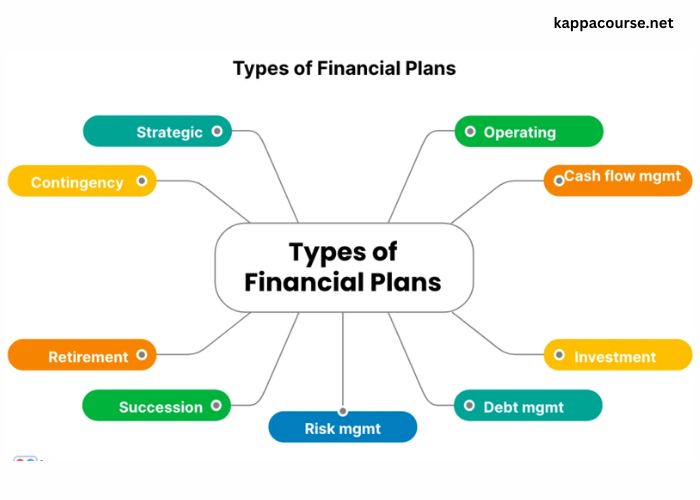

Risk Management: Protecting Your Assets

In the financial frontier, risk is inevitable. The key is to manage and mitigate it effectively.

Insurance

Insurance is a critical tool for managing risk. It comes in various forms, such as health insurance for individuals and liability insurance for businesses. Having the right insurance coverage can protect you from financial ruin in the face of unexpected events.

Asset Protection

Protect your assets by using legal structures such as trusts and limited liability companies (LLCs). These structures can shield personal and business assets from creditors and lawsuits.

Continuous Learning: Staying Informed

The financial frontier is in a constant state of flux. Staying informed about the latest developments in finance, technology, and economics is essential for success.

Reading and Courses

Read financial news, books, and research papers to stay updated. Consider taking courses or attending seminars to deepen your financial knowledge.

Adaptability

Be ready to adapt your strategies as the financial landscape changes. What worked yesterday may not work tomorrow. Embrace new technologies and financial instruments, but do so with caution and a thorough understanding.

Long-Term Perspective: Patience Pays Off

In today’s fast-paced world, it’s easy to succumb to the allure of quick gains and instant gratification. However, a long-term perspective is often the most successful strategy.

Investing for the Long Term

When investing, think in terms of years, if not decades. Compounding interest can turn small investments into substantial wealth over time. Avoid the temptation to constantly buy and sell stocks based on short-term market fluctuations.

Building Businesses

For entrepreneurs, building a successful business usually takes years of hard work and perseverance. Focus on creating long-term value rather than chasing short-term profits.

Financial Advisors: Seeking Professional Guidance

Navigating the financial frontier can be daunting, and it’s perfectly reasonable to seek professional help.

Financial Advisors

A qualified financial advisor can provide valuable insights and help you create a comprehensive financial plan tailored to your goals and risk tolerance.

Legal and Tax Experts

For businesses, legal and tax experts can ensure compliance with complex regulations and help optimize tax strategies, saving you money in the long run.

Ethics and Integrity: The Bedrock of Trust

In the financial world, trust is paramount. Whether you’re dealing with clients, investors, or partners, maintaining a high level of ethics and integrity is essential for long-term success.

Transparency

Be transparent in your financial dealings. Honesty builds trust, and trust leads to lasting relationships.

Compliance

Adhere to all financial regulations and laws. Non-compliance can lead to legal troubles that can be financially devastating.

Emergency Planning: Preparing for the Unexpected

No matter how well you plan, the unexpected can still happen. Having a contingency plan in place is vital.

Emergency Funds

Maintain an emergency fund for personal finances and a cash reserve for businesses. These funds can help you weather unexpected financial storms.

Business Continuity

For businesses, create a business continuity plan that outlines how operations will continue in the face of disasters or unforeseen events.

Mindfulness and Stress Management: Mental Health Matters

The financial frontier can be stressful, and chronic stress can have severe financial consequences. It’s crucial to take care of your mental well-being.

Mindfulness Practices

Incorporate mindfulness practices into your daily routine to reduce stress and make better financial decisions.

Work-Life Balance

Maintain a healthy work-life balance. Burnout can impair your ability to make sound financial decisions.

10. Adaptability: Thriving in Change

The financial frontier is marked by constant change. Successful individuals and businesses are those that can adapt and thrive in this dynamic environment.

Innovation

Embrace innovation and technology to stay competitive. Consider how emerging technologies like blockchain and artificial intelligence can impact your financial strategies.

Agility

Be agile in your decision-making. If a strategy isn’t working, don’t hesitate to pivot and try something new.

Conclusion

Navigating the financial frontier is a challenging but rewarding endeavor. By prioritizing financial literacy, diversification, risk management, continuous learning, a long-term perspective, professional guidance, ethics, emergency planning, mindfulness, and adaptability, you can increase your chances of achieving financial success and security.

Remember that the financial frontier is not a static landscape; it’s constantly evolving. Success requires not only a solid foundation of knowledge and strategy but also the ability to adapt and thrive in an ever-changing environment. Whether you’re an individual investor or a business owner, these strategies can help you chart a course to financial success in today’s dynamic world.