Bitcoin, the first and most famous cryptocurrency, has dramatically changed the financial landscape since its inception in 2009. One of the most extensive developments in the cryptocurrency market has been the advent of Bitcoin futures. These financial devices permit buyers to take a position at the destiny rate of Bitcoin, presenting new avenues for funding and threat management. This article delves into how Bitcoin futures are shaping the cryptocurrency market, highlighting their advantages, demanding situations, and normal effects. Additionally, if you want to know more about investments and firms, you may visit this Homepage.

Understanding Bitcoin Futures

Bitcoin futures are derivative contracts that obligate the client to purchase Bitcoin or the vendor to promote Bitcoin at a predetermined fee at a selected future date. These contracts are standardized and traded on regulated exchanges, which include the Chicago Mercantile Exchange (CME) and Bakkt. Bitcoin futures allow traders to hedge against rate fluctuations, speculate on charge movements, and gain publicity for Bitcoin without proudly owning the real cryptocurrency.

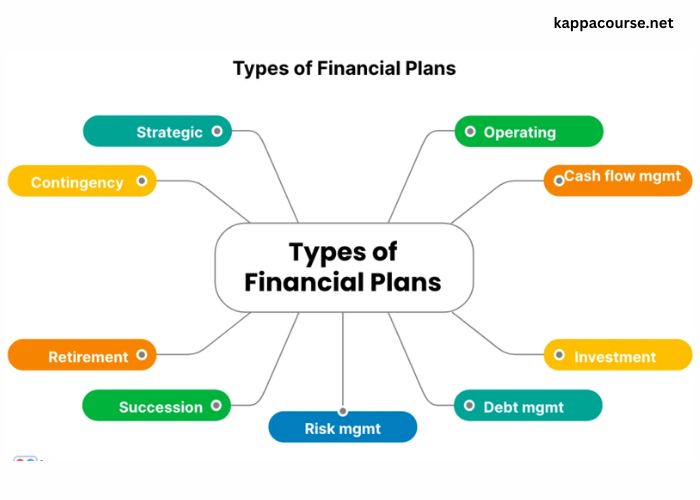

The Benefits of Bitcoin Futures

Market Maturity and Legitimacy

The creation of Bitcoin futures has contributed considerably to the maturation and legitimacy of the cryptocurrency market. By providing a regulated environment for buying and selling, futures contracts entice institutional buyers who may also be hesitant to make investments directly in cryptocurrencies due to regulatory and protection concerns. This inflow of institutional capital allows the marketplace to stabilize and enhances its credibility.

Price Discovery

Bitcoin futures play an important role in the charge discovery process. As futures contracts are traded on regulated exchanges with transparent pricing mechanisms, they provide valuable facts about marketplace sentiment and expectations for Bitcoin’s future charge. This record allows traders to make more informed choices and contributes to a greater green market.

Hedging and risk management

Bitcoin futures offer a powerful device for hedging and risk control. Investors and corporations worried about the cryptocurrency market can use futures contracts to guard themselves against unfavorable price moves. For instance, a Bitcoin mining organization can lock in destiny sales costs by selling Bitcoin futures, thereby securing sales and mitigating the hazard of fee volatility.

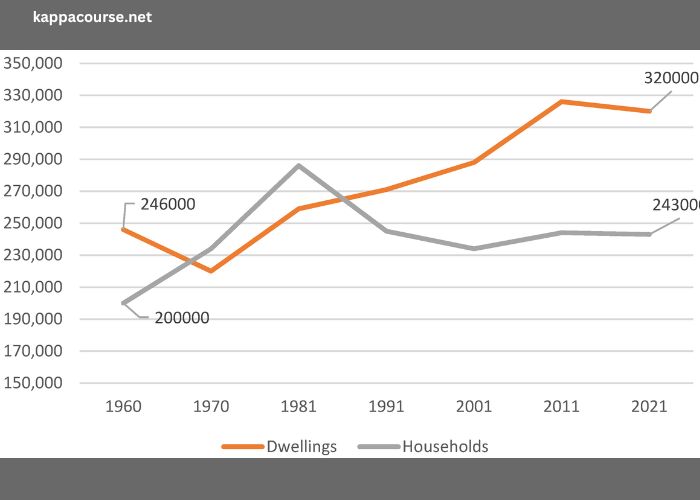

Increased Liquidity

The trading of Bitcoin futures provides liquidity to the cryptocurrency market. Higher liquidity reduces the effect of massive trades on the market price, leading to greater fees and smoother trading conditions. This improved liquidity benefits all marketplace contributors, from individual investors to large establishments.

Access to leverage

Bitcoin futures allow buyers to benefit from Bitcoin’s publicity with a smaller initial investment through the use of leverage. By setting down a fraction of the overall settlement value as a margin, buyers can control a larger role and increase their capability returns. However, it’s critical to notice that leverage also increases the potential for losses, making it a double-edged sword.

Challenges and Risks of Bitcoin Futures

High Volatility

Despite their blessings, Bitcoin futures are not resistant to the high volatility inherent in the cryptocurrency marketplace. Rapid and massive price modifications can lead to sizeable profits or losses, particularly for leveraged positions. This volatility calls for buyers to exercise caution and adopt robust risk control strategies.

Market Manipulation

The possibility of marketplace manipulation is a concern for Bitcoin futures, as it’s miles for the wider cryptocurrency marketplace. Due to the rather small length of the Bitcoin market compared to traditional economic markets, massive trades or coordinated movements can considerably affect costs. Regulatory oversight and transparency measures are crucial to mitigating these risks.

Regulatory Uncertainty

The regulatory environment for Bitcoin futures varies throughout jurisdictions and is still evolving. Changes in regulations or differences in regulatory processes can affect the provision and elegance of Bitcoin futures as a funding vehicle. Investors ought to be informed about regulatory traits and their potential implications.

Complexity and risk management

Trading Bitcoin futures entails a higher level of complexity in comparison to shopping for and preserving Bitcoin without delay. Investors want to recognize the mechanics of futures contracts, together with margin requirements, expiration dates, and agreement procedures. Effective danger control strategies are important to navigate these complexities and protect against potential losses.

Conclusion

Bitcoin futures are reshaping the cryptocurrency market by enhancing market adulthood, offering charge discovery, supplying hedging possibilities, and increasing liquidity. While they come with challenges including excessive volatility, marketplace manipulation dangers, and regulatory uncertainty, their ordinary impact on the market is largely positive. By attracting institutional buyers and fostering a more stable and efficient market, Bitcoin futures play an important role in the persistent increase and improvement of the cryptocurrency environment.

As the cryptocurrency market evolves, the role of Bitcoin futures may expand further, with new merchandise and innovations enhancing their utility and appeal.